China’s artificial intelligence and semiconductor companies are increasingly raising capital on Hong Kong’s stock markets, securing billions of dollars as global technology rivalry intensifies. With growing restrictions on advanced chip and technology exports from the United States, Hong Kong has emerged as a key financial hub for Chinese firms seeking international capital and expansion opportunities.

Several high-profile initial public offerings have highlighted this trend. AI models have raised billions of Hong Kong dollars in their IPO, supported by strong global investor demand. The successful listing reflects confidence in China’s fast-growing AI sector despite competition and ongoing geopolitical tensions.

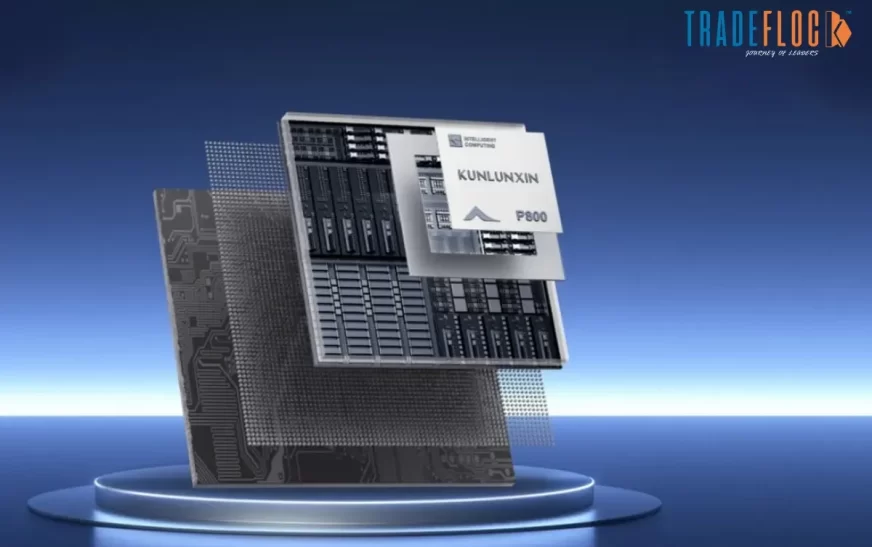

Semiconductor companies have also attracted significant attention in chip markets, such as Omnivision Integrated Circuits and GigaDevice Semiconductor, which raised substantial funds through a Hong Kong listing, with their shares rising on debut. The capital raised will be allocated to research and development, chip design, and production expansion, supporting China’s goal of reducing its dependence on foreign semiconductor technology.

The wave of technology IPO’s has helped revive Hong Kong’s stock market, lifting investor sentiment after years of weak activity. Analysis notes that Beijing’s emphasis on self-reliance in critical technologies has made AI and semiconductors a priority sector, encouraging both state support and private investment.

Despite the positive momentum, challenges remain. Many AI firms remain unprofitable, and geopolitical risk continues to constrain access to overseas markets. However, Hong Kong’s position as a gateway between China and global investors remains strong.

Read More- India is expected to grow 7.4% in FY26.

Overall, the surge in fundraising underscores China’s determination to advance its AI and semiconductor capabilities and reinforces Hong Kong’s role as a major centre for tech financing amid intensifying global competition.