ASML, the world’s largest supplier of advanced semiconductor manufacturing equipment, reported better-than-expected fourth-quarter earnings, driven by a sharp increase in demand from chipmakers investing heavily to support artificial intelligence applications. The Dutch company said Q4 bookings reached 13.2 billion euros, significantly exceeding analysts’ prior quarter estimates. The surge highlights renewed confidence among semiconductor manufacturers as they ramp up capacity to meet growing demand for AI-related chips used in data centres, cloud computing, and advanced computing systems.

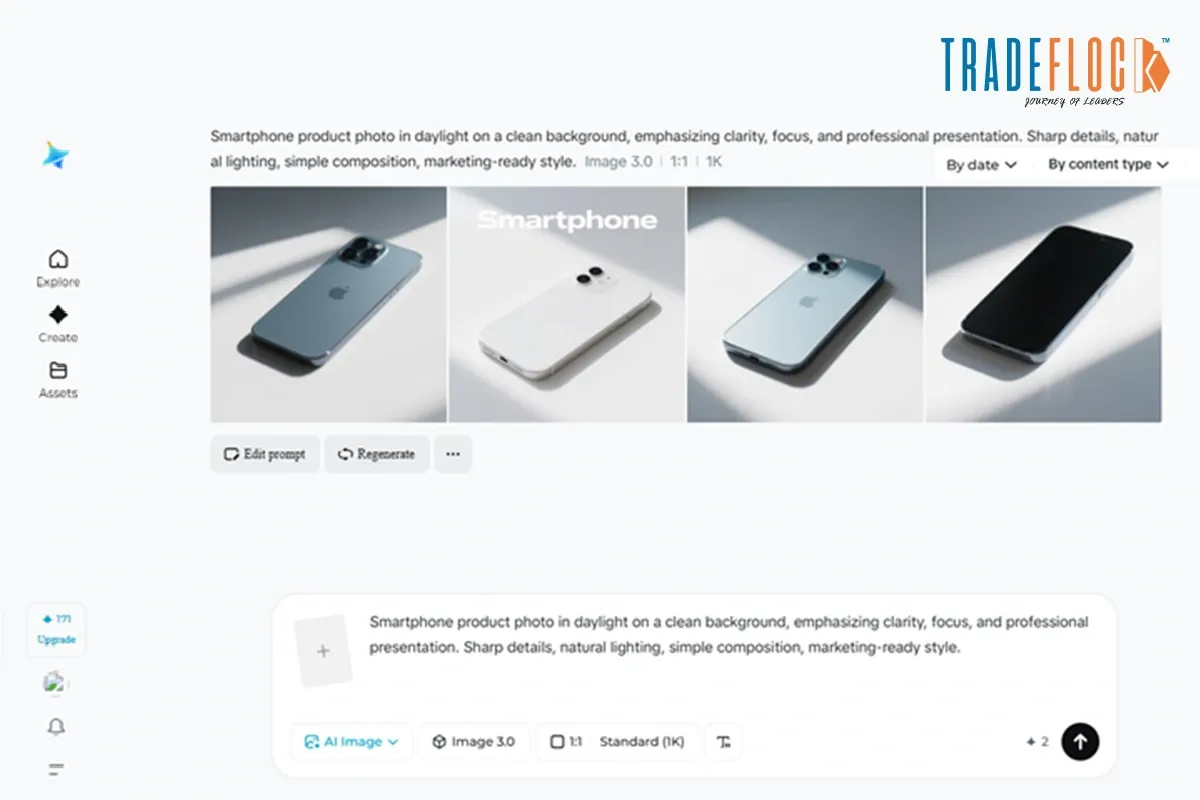

ASML Q4 orders beat on surging AI chip demand. ASML’s equipment, including its highly sought-after extreme ultraviolet (EUV) lithography machines, is critical to producing cutting-edge logic and memory chips. Rising orders suggest that customers remain committed to long-term investment despite near-term volatility in the broader semiconductor market. The company noted that demand was largely driven by major chipmakers expanding production to serve artificial intelligence workloads. AI has emerged as a key growth engine for the semiconductor industry, offsetting weaker demand in consumer electronics such as smartphones and personal computers.

Buoyed by strong order intake, ASML raised its 2026 sales outlook, forecasting revenue of 34-39 billion euros, above prior market expectations. The company said the strong bookings pipeline supports confidence in sustained growth, particularly as AI adoption accelerates across the industry. However, ASML also announced plans to cut approximately 1,700 jobs globally, citing the need to streamline operations and improve efficiency amid shifting market dynamics. The company clarified that the reduction in contact is part of a border recognition and does not reflect weakening demand for its core technology.

You might also like: Micron’s $24 billion Singapore Chip Fab Plant Plan

ASML executives emphasized that while the semiconductor industry remains cyclical, AI-driven demand provides a strong structural tailwind. The company continues to invest heavily in research and development to maintain its technological leadership. The results reinforce ASML’s central role in the global chip supply chain and underscore how artificial intelligence is reshaping capital-spending priorities across the semiconductor sector.