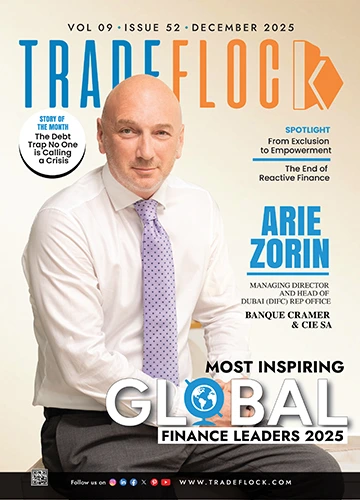

Turning Financial Insight into Lasting Value

Arie Zorin

Managing Director and Head of the Dubai (DIFC) Representative Office

Banque Cramer & Cie SA

Turning Climate Ambition into Financial Infrastructure

Arie Zorin

Managing Director and Head of the Dubai (DIFC) Representative Office

Banque Cramer & Cie SA

Arie Zorin-Most Inspiring Global Finance Leaders 2025

By the age of thirteen, Arie Zorin had already lived across multiple countries, absorbing cultures, languages, and the subtle dynamics of influence—an early foundation for a career shaped by adaptability and leadership. Born into a family of musicians in Odessa, he learnt young that excellence commands attention and that true leadership emerges from mastery, presence, and example.

Today, as Managing Director and Head of the Dubai Representative Office* of Banque Cramer (Switzerland), Arie brings that same discipline and human intuition to private banking. In an exclusive interview with TradeFlock, he reflects on building trust-driven client relationships from the ground up, leading diverse cross-cultural teams, and positioning Dubai as a long-term hub for personalised private banking.

What in your childhood inspired your path to leadership in finance?

My background is rooted in Odessa, a cosmopolitan port city shaped by international influences and a strong musical heritage. Violins and pianos filled our home, yet what influenced me most were the people who surrounded my parents. Many of their friends, like themselves, were international musicians of exceptional calibre—disciplined, exacting, and quietly authoritative. Watching them rehearse, perform, and interact, I understood early on that leadership does not begin with position or power. It begins with mastery. When excellence is consistent and visible, authority follows naturally.

Because my parents travelled and migrated extensively, by the age of thirteen, I had already lived in seven cities across four countries. As the eldest son, this constant movement shaped me deeply. It fostered independence and adaptability, but it also sharpened my awareness of group dynamics. I learnt to read people quickly, to understand how influence forms within a group. Very early, I came to believe that leadership is largely innate. Talent cannot thrive without hard work. You can recognise it at school, among friends, or on a football field. Some individuals set the tone effortlessly—not through dominance, but through presence, credibility, and example.

I played several instruments as a child, yet at the age of 9, I decided not to pursue music professionally. Growing up immersed in art paradoxically pushed me to step outside that world and carve my own path, while remaining faithful to the values I had inherited. That decision helped me develop a sense of singularity and comfort with being an outsider. I have always believed that difference, when combined with discipline, becomes a strength rather than a limitation.

During adolescence, my ambitions evolved constantly. I imagined myself as a journalist, then as a diplomat and even an entrepreneur. In my early twenties, I spent a year and a half at the French Embassy in Moscow, working closely with the French Ambassador. Each experience added perspective, but none felt fully aligned. That clarity came later through the study of law in France and England and my admission to the Paris Bar. For twenty years, I practised as a transactional lawyer, focusing on mergers and acquisitions, investments, and complex negotiations with major international law firms such as Gide, Ashurst, and Herbert Smith. In 2005, I founded Zorinlaw International in Paris, reflecting my entrepreneurial instinct. Law gave me rigour and structure, yet I was always drawn to creative solutions and the human dimension behind transactions.

My transition into private banking came after I had gained maturity. Starting with no clients, leadership initially meant earning trust one conversation at a time. As the business grew, it became about building teams, delegating responsibility, and inspiring rather than controlling. Looking back, my shift from music to law and finance feels less like a career decision than a continuation of a deeper legacy. My great-great-grandfather was a first-guild merchant in Odessa, authorised for large-scale international trade. Today, leading in Dubai, I feel that same continuity—between a city that once connected worlds and a hub shaping the future of global finance.

How was the famous mathematician Gabriel Cramer linked to the Cramer institution?

With Gabriel Cramer, the family also produced a mathematician who was the first to show with equations that loss, when significant, causes us more pain than an equally large gain brings us joy. This principle of modern asset management is something we have inherited. Throughout history, we have always combined entrepreneurship, principles, and academic rigour. This still shapes us today, as our shareholders are predominantly entrepreneurs themselves. This is precisely what our Swiss and international clients appreciate: they meet an entrepreneur talking to another entrepreneur.

What’s next for you, and how do you keep pace with the industry?

The future of finance will not belong to one geography alone. While Switzerland continues to embody quality, trust and efficiency, we clearly see the rise of global hubs such as Dubai and the growing importance of the Middle East. As Swiss bankers, our responsibility is not to resist this evolution but to engage with it, combining Swiss financial excellence with the innovation shaping traditional finance and digital finance in order to better serve clients who operate in, from and through the region.

Looking ahead, my primary ambition is to develop our client base in the Middle East, focusing on Emirati entrepreneurs as well as high-net-worth families across the GCC. At the same time, I aim to strengthen relationships with international expatriates in Dubai, who bring diverse perspectives and entrepreneurial drive.

To stay current in a rapidly evolving industry, I combine continuous learning, attentive observation, and close engagement with clients and colleagues. While technology, markets, and regulation change quickly, the principle remains the same: understanding the ambitions and challenges of the people we serve allows me to anticipate their needs and adapt our strategies proactively.

Ultimately, my plans are centred on building trust, fostering enduring relationships, and creating long-term value, in line with the entrepreneurial and client-focused philosophy that has guided our institution since its origins with the founding families in 1706.

The Advantage

Banque Cramer combines the agility of a boutique bank with global expertise. Usually, with minimum relationships starting at around USD 5 million, it serves high-net-worth individuals and family offices seeking personalised, long-term wealth stewardship. Its senior bankers bring entrepreneurial mindsets, cross-sector experience, and the ability to craft tailored solutions in complex financial and family contexts.

What challenges have defined your career, and how have you overcome them?

The most challenging aspect of my professional journey has been navigating constant transitions across professions, countries, and cultures while remaining true to myself. Each move required more than technical adaptation; it demanded a deep understanding of diverse industries, from services and manufacturing to banking and distribution, each defined by its own pace and expectations.

I have led teams in highly diverse environments as a lawyer and a banker, including leadership roles in Paris, Moscow, Geneva and Dubai. My transition from M&A lawyer to private banker unfolded between France and Switzerland, each context shaped by distinct professional and cultural codes. Early in my career, I realised the real challenge was not to impose a uniform approach but to observe carefully, listen attentively, and adapt thoughtfully. Over time, I learnt to draw the best from each culture—discipline from some, pragmatism and relational intelligence from others—while remaining anchored to my core values.

Adaptability has been essential, but lucidity and honesty about one’s strengths and weaknesses have proven equally critical. While reflection and study offer perspective, the greatest lessons have always come from people. Working alongside exceptional individuals across complex transactions and diverse industries has shaped my understanding of leadership and decision-making.

As my responsibilities grew, leadership evolved from personal execution to creating alignment across diverse teams. In Dubai, where cultures and expectations intersect daily, this philosophy is especially relevant. Challenges never disappear—they transform. Leadership, I have learnt, is about evolving faster than the challenges themselves.

Who are the bank’s current shareholders, and what drives them?

After the Cramer family stepped back, the bank entered a new chapter under the ownership of entrepreneurs whose vision and values are deeply embedded in its philosophy. Today, Banque Cramer & Cie is wholly owned by Norinvest Holding SA, whose principal shareholders include the Esposito family, the Valartis Group, and long-standing management partners.

At the centre is Massimo Esposito, born in Naples, who arrived in Switzerland at 22. Massimo began his career in industrial and real estate ventures, transforming struggling companies into successful enterprises. He later entered financial services, acquiring asset management firms, and ultimately restructuring Cramer&Cie as a bank in 2003. His strategic acquisitions, including the integration of Valartis Bank Switzerland in 2014, brought Gustav Stenbolt into the shareholder base.

Gustav Stenbolt, born in Norway, is a seasoned entrepreneur and investor with a notable career in real estate and finance across Eastern Europe and Asia. His international experience complements Massimo’s expertise, particularly in understanding global markets and entrepreneurial clients.

What unites both is their identity as entrepreneurs first. This DNA influences the bank: while rooted in Swiss discipline, discretion, and efficiency, the bank also deeply understands its clients, many of whom are entrepreneurs themselves. Personally, their example has shaped my leadership: combining rigour with vision and focusing on clients as people with ambitions and legacies, not just as portfolios.

At a Glance | Arie Zorin & Banque Cramer & Cie SA

The Leader

Arie Zorin, Managing Director and Head of the Dubai Representative Office of Banque Cramer & Cie SA, embodies a leadership style built on expertise, precision, and human insight. Trained as a transactional lawyer, he spent more than two decades navigating complex mergers and acquisitions, leveraged and management buyouts, capital markets transactions, and cross-border deals involving global investment funds. This extensive legal and transactional experience instilled in him a disciplined, analytical mindset, a keen eye for risk, and the ability to balance strategy with the human dynamics behind every financial decision.

The Journey

Arie’s transition into private banking was both natural and deliberate. After founding his own international legal practice and advising high-net-worth clients, family offices, and private banks across multiple jurisdictions, he joined Banque Cramer & Cie SA in 2017. He successfully built the Moscow office before strategically relocating operations to Dubai, driven by a long-term conviction in the UAE’s growing role as a global financial hub rather than a short-term response to geopolitical shifts.

The Bank

With roots dating back more than 300 years, Banque Cramer & Cie SA is one of Switzerland’s oldest independent private banks. Headquartered in Geneva, with branches in Zurich and Lugano, the bank operates exclusively under Swiss jurisdiction, with all client accounts booked in Switzerland. Its stability is anchored in strong capital ratios, conservative risk management, and a client-centric approach that emphasises discretion and regulatory robustness. In 2025, the bank received the award for Best Boutique Private Bank in Switzerland.

The Philosophy

At the heart of Arie’s leadership and Banque Cramer’s approach lies a singular belief: in private banking, trust, shareholder proximity, and speed of execution are far more valuable than scale. Excellence in service, discretion, and a strategy focused on the preservation, growth, and transmission of wealth define every client relationship.

Banque Cramer is regulated by FINMA in Switzerland and as a representative office by DFSA in DIFC