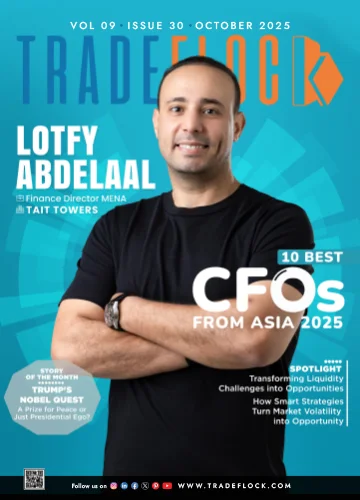

Driving Innovation and Growth Across Global Markets Lotfy Abdelaa

Lotfy Abdelaal

Finance Director MENA

TAIT Towers

Driving Innovation and Growth Across Global Markets

Lotfy Abdelaal

Finance Director MENA

TAIT Towers

Lotfy Abdelaal - 10 Best CFOs from Asia 2025

Every strategic decision carries weight, but few moments define a leader’s impact like navigating uncertainty under pressure. Early in his career, Lotfy Abdelaal faced a similar challenge: overseeing the financial closure of a multi-million-dollar project, where delays and fragmented reporting threatened both timelines and margins. Through meticulous analysis and proactive collaboration, he not only stabilised the project but turned it into a benchmark for operational and financial alignment. That moment marked the beginning of a career defined by foresight, precision, and the ability to translate complexity into clarity. Over nearly two decades across Egypt, Saudi Arabia, and the UAE, Lotfy has established a reputation for transforming financial insights into actionable strategies. From his early accounting roles at Salah Abdelftah Accounting & Auditing to leadership positions at Saudi Salco Contracting and VINCI Construction, he honed the skill of aligning financial discipline with business vision. Each role strengthened his ability to empower teams, foster collaboration, and guide decision-making with confidence. Today, as Finance Director (MENA) at TAIT Towers, Lotfy leads a finance function that is both a compass and a catalyst. He embeds intelligence into every decision, aligning strategy with execution while cultivating a culture where accountability and innovationcoexist. Under his guidance, finance goes beyond reporting—it becomes a driver of growth, foresight, and long-term value. TradeFlock spoke with him to explore the principles, strategies, and mindset that have propelled him to the forefront of Asia’s finance leadership. His story offers rare insight into how great CFOs transform numbers into vision, challenges into opportunity, and strategy into lasting impact.

What early experiences shaped your approach to financial leadership, and how has global exposure refined your understanding of MENA’s financial landscape?

My early career taught me that finance isn’t just about precision; it’s about perspective. I started as an accountant, but it didn’t take long to realise that behind every financial statement lies a story of decisions, discipline, and sometimes, dreams. Working across different markets and industries, I came to see how numbers reflect human behaviour, market culture, and ambition. Each environment offered its own rhythm, from fast-paced creative ventures to highly regulated infrastructure projects. Navigating that diversity shaped how I think: adaptable, analytical, and always mindful that one financial solution rarely fits all.In the MENA region, financial leadership goes beyond technical skill. It demands context, empathy, and strategic agility — understanding how economies move, how trust drives partnerships, and how to align global standards with local realities. Those early experiences instilled a belief that finance isn’t a control function; it’s a strategic compass guiding creativity, growth, and transformation while staying anchored in integrity.

"Great financial leadership isn’t about playing it safe — it’s about making smart, informed, and courageous decisions that move both business and people forward."

What personal milestone from your TAIT journey holds special meaning — one that still resonates today?

Amid all the numbers, systems, and strategies, the proudest moment wasn’t a headline achievement. It was the point when finance became a trusted voice in the business conversation. I recall noticing a shift: creative, operational, and commercial teams started reaching out to finance not out of obligation, but out of genuine curiosity. That subtle change signalling real collaboration was transformative. Building that trust didn’t happen overnight. It grew conversation by conversation, earned through transparency, consistency, and shared goals. This milestone represents more than financial progress; it reflects a cultural transformation within the organisation. Financial leadership matures when the function stops guarding numbers and starts shaping ideas, standing at the centre of innovation rather than on the sidelines. Moments like these remind us that leadership is as much about people as it is about numbers.

What part of TAIT’s financial transformation excites you most right now, and why does it matter?

The current financial transformation is exciting because it’s redefining decisionmaking, moving from simple data collection to true financial intelligence. We’re moving beyond traditional reporting to a model where insight fuels action. Numbers now directly connect to narratives that shape the company’s direction in real-time. I’ve seen teams respond immediately to the impact of their decisions — from creative concepts to procurement choices to project milestones. They begin thinking like business owners, not just executors. Finance becomes a mindset, not just a function. What makes this journey meaningful is the cultural evolution it represents. Information flows freely, collaboration thrives, and decisions are made with confidence rather than assumption. This is the future of finance: predictive, integrated, and embedded at the heart of the organisation. It doesn’t just improve systems, it uplifts the way people think and act.

How is TAIT leveraging digital finance tools, analytics, or automation to drive smarter decisions and efficiency?

At TAIT, digital finance is more than a tool; it’s a mindset shift. It’s about transforming how decisions are made, how value is created, and how leadership operates. Automation allows the team to move beyond repetitive, transactional work and focus on strategic interpretation. Real-time dashboards, integrated forecasting models, and analytics let us see the business as it unfolds, not months later in a report. The real impact goes beyond technology. Leaders across the business are empowered with the right information at the right time, giving them the clarity and confidence to make faster, smarter, and more aligned decisions. Finance no longer reports the past; it illuminates the future. By combining automation with human judgment and analytics with experience, we’ve created a more agile, transparent, and intelligent organisation — one where data enhances leadership rather than replacing it.

What are the most pressing financial gaps or inefficiencies in the live entertainment and events technology sector, and how is TAIT addressing them?

The live entertainment and events technology sector is dynamic, creative, fast-moving, and full of potential. Yet that pace exposes financial gaps that can limit sustainable growth. The biggest challenge isn’t just cost, it’s visibility and timing. Projects require heavy upfront investment long before client payments arrive, creating structural cashflow tension. Many organisations still work with fragmented data and delayed reporting, making it hard to align financial reality with operational momentum. TAIT addresses this with a connected financial ecosystem that aligns project delivery with commercial reality. Forecasting, budgeting, and reporting are integrated into a single framework, giving leadership real-time insights into cash, margin, and performance. Beyond systems, the solution lies in culture. Financial awareness is embedded at every level, enabling creative and operational teams to understand the financial implications of their decisions. Closing these gaps protects not only profit, but potential, giving creativity the freedom to thrive sustainably.

If you could bottle one “humanised lesson” from your journey, what would it be?

Lead with clarity, but manage with empathy. Finance provides structure, logic, and truth; leadership gives it meaning. The best financial decisions aren’t made in isolation; they are made in conversation, with people, with purpose, and with understanding. Empathy strengthens financial discipline. When teams understand why decisions are made, alignment happens naturally, and accountability is shared. Leadership in finance isn’t about control; it’s about connection. It shows people how their choices shape the bigger picture, contribute to value creation, and how finance can be an enabler rather than a gatekeeper. Numbers may measure success, but people sustain it, and that understanding shapes the kind of leader one becomes.

Beyond the balance sheets, what’s one “off-script” goal that reveals the dreamer behind the director?

Beyond balance sheets and forecasts, the “offscript” goal is to inspire and develop the next generation of finance leaders — professionals who see finance not as a back-office function, but as a platform for transformation. The aim is to shift perception from reactive and transactional to strategic, creative, and human. Too often, young professionals focus only on compliance and control. The vision is to show that true financial leadership combines vision with numbers, insight with innovation, and values with growth. One day, the goal is to create a learning and mentorship platform across the MENA region, nurturing a mindset where finance leaders guide with both data and empathy.

What advice would you give to emerging finance leaders aspiring to make an impact in a global, tech-driven industry?

The advice is simple but timeless: be curious, be courageous, and be human. The future of finance will be defined not by who can read numbers, but by who can interpret, communicate, and act on them with clarity and conviction. In a global, tech-driven world, data is abundant — insight, judgment, and integrity are what set leaders apart. First, be curious. Learn beyond finance, understand operations, strategy, and people. The best leaders speak the language of the business, not just the balance sheet. Second, be courageous. Technology is transforming everything. Embrace it, lead it, and let innovation make you faster and sharper, but never let it replace critical thinking. Finally, be human. Finance is about trust. Data drives efficiency, empathy drives alignment. Leaders who combine both will define the future of the profession