Leader in Digital and Financial Excellence

Erwantho Siregar

Finance Director

PT Duta Intidaya Tbk (Watsons Indonesia)

Leader in Digital and Financial Excellence

Erwantho Siregar

Finance Director

PT Duta Intidaya Tbk (Watsons Indonesia)

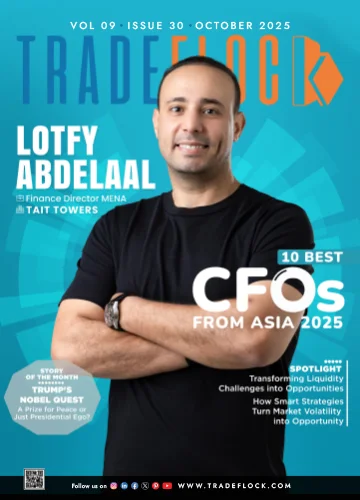

Erwantho Siregar- 10 Best CFOs from Asia 2025

In a retail landscape where operational costs and margins are under constant pressure, one finance strategy turned losses into profitability, reshaping the business growth trajectory. Erwantho Siregar built this approach over a career spanning global and domestic roles. Starting at Deloitte and PT Goodyear Indonesia, he developed a foundation in accounting, auditing, and compliance. International stints with Wyeth and Baxter Healthcare in Australia expanded his perspective on finance, operations, and strategic decision-making. Back in Indonesia, he led transformative finance functions at AstraZeneca and PT Henkel Indonesia, later driving efficiency and profitability as CFO at PT Hero Supermarket Tbk. Today, as Finance Director and Corporate Secretary of PT Duta Intidaya Tbk (Watsons Indonesia), Erwantho combines digital innovation, strong financial governance, and strategic foresight to guide a publiclisted company toward sustainable growth. In an exclusive conversation with TradeFlock, he shares insights on leadership, innovation, and navigating Indonesia’s evolving financial landscape.

What experiences in your early finance roles shaped your growth into a strong leader today?

Early in my career, I discovered that finance is more than numbers – it connects people, processes, and technology to achieve meaningful results. As a business consultant, I designed end-to-end solutions that integrated operational processes with accounting and IT systems. Collaborating with clients from diverse backgrounds accelerated my understanding of complex workflows and taught me how to efficiently bridge operational and financial priorities. Later, traveling as an internal auditor across ten countries in the Asia-Pacific exposed me to varied compliance practices and internal controls. Adapting recommendations to each context strengthened my analytical skills and taught me to make thoughtful, strategic decisions. Being part of SAP implementations in four countries was a transformative experience. I learned how to manage change, leverage technology, and streamline operations. These experiences, combined, shaped my leadership style, enabling me to guide teams confidently while maintaining a strong focus on core business fundamentals.

What milestone or financial challenge most influenced how you make high-stakes decisions today?

Two experiences had a lasting impact on how I approach critical financial decisions. The first was in Indonesia, during the launch of the National Health Insurance. Companies needed to submit drug tenders while balancing shortterm profitability with long-term opportunities. Working with the commercial team, I developed a pricing framework that guided decisions both in the present and for the future. This approach helped the company secure essential listings in the first year and helped maintain sustainable performance in subsequent cycles. The second milestone was in Australia with the entry of generic compounded drugs. I created a flexible pricing model to simulate cost, volume, and margin scenarios for both patented and generic products. This model improved profitability and gave the company a structured method to navigate complex, high-stakes decisions with confidence.

What skills, mindsets, or habits will help finance professionals succeed in Indonesia and globally?

Core skills like accounting, internal control, and risk management remain essential, but today’s finance leaders need more. Strategic thinking, digital awareness, commercial insight, and the ability to collaborate across cultures and generations are vital. Business partnering goes beyond reporting numbers—it involves guiding decisions, highlighting risks, and contributing to long-term strategy. Equally important are mindset and habits. Networking with peers ensures timely knowledge, curiosity about technology fosters innovation, and ongoing learning through courses and certifications keeps skills relevant. Leading diverse teams with empathy and adaptability strengthens decision-making. Combining these capabilities enables finance professionals to make meaningful contributions locally and globally

What recent finance initiative helped improve performance or efficiency in your company?

Through two key initiatives, the company strengthened efficiency and optimized operations, leading to a marked improvement in its financial performance in 2024. The first focused on cost management while supporting growth and expansion. By prioritizing essential spending and continuing to invest in revenue-generating activities, we maintained operational efficiency and minimized disruptions for our teams and stakeholders. Operational costs grew at less than half the rate of revenue, and operating income rose from under one percent to over four percent. The second initiative strengthened the balance sheet through careful loan management. By planning drawdowns, repayment timing, and interest costs, we reduced the debt-to-equity ratio from 38.2 to 14.5 while still funding operations and expansion. Together, these measures enhanced the company’s financial stability and provided it with the flexibility to pursue future growth.

What are the main gaps in Indonesia’s finance sector, and how can they be addressed in the coming years?

Based on my observations, Indonesia’s finance

sector faces gaps in technical skills, commercial

insight, and digital proficiency. While graduates

often have strong accounting knowledge,

businesses increasingly need professionals who

are agile, tech-savvy, and aware of evolving

regulations.

Bridging this gap begins with education.

Practical exposure through internships and

curricula that integrate IT, digital tools, and AI

gives students real-world experience and prepares

them for complex challenges. For current

professionals, continuous upskilling is critical.

Pursuing certifications, attending seminars,

and staying informed about regulatory updates

strengthen expertise and adaptability. Companies

can also develop internal talent, foster innovation

and ensure their teams remain competitive in a

rapidly changing environment.